Paisayaar APK is a free credit checking app available for iOS. This app was developed by EWIN Marketing Consulting Pvt Ltd and is categorized under Business Productivity, especially Finance. With this app, you can easily check your credit score with multiple credit bureaus, including CIBIL, for free. Additionally, you can easily monitor your credit score by getting free monthly credit report updates for life.

It provides detailed credit reports to help you understand and improve your credit score. You can also read and download your credit report in Hindi, Marathi, Gujarati, Telugu, Kannada, and other regional languages. The app also displays your chances of being approved for loan and credit card offers based on your eligibility. Additionally, the app offers an EMI calculator to help you plan your loan better.

Paisayaar App has earned the trust and goodwill of nearly 25 million customers in the last seven years. Download the App now to maintain a healthy balance. The app can be contacted via a toll-free number, WhatsApp, and email.

What is Paisayaar APK?

Paisayaar APK is designed to be your preferred solution for managing your financial health and accessing multiple loan options. The app allows you to monitor your credit score. The updated reports are available free of charge every month. It contains detailed credit reports in multiple regional languages, ensuring accessibility to various user groups across India.

Users benefit from choosing from a wide range of financial products offered by over 60 partner institutions, including leading banks and NBFCs, depending on their lifestyle, needs, and eligibility criteria. With over 35 credit card options and instant microloans ranging from ₹1,000 to ₹50,000, it covers immediate cash needs and personal financial goals.

Users can easily compare, select, and apply for the most suitable loan or card by browsing. Offers pre-approved quotes to ensure minimal paperwork and fast delivery. In addition, personal expert help is available to guide people through the final stages.

A wide range of loan products are offered for both personal and business use, including competitive mortgage rates and options for those looking to transfer existing loans. Entrepreneurs can explore various offers to expand their business while existing borrowers can benefit from home loan options. Paisayaar App promises to be a lifelong financial partner to its users and provides a range of free loan products and advice.

Because creditworthiness is necessary, this platform is an essential tool for those who want to maintain or improve their creditworthiness and easily access financial services digitally directly from major banks and financial institutions.

Features:

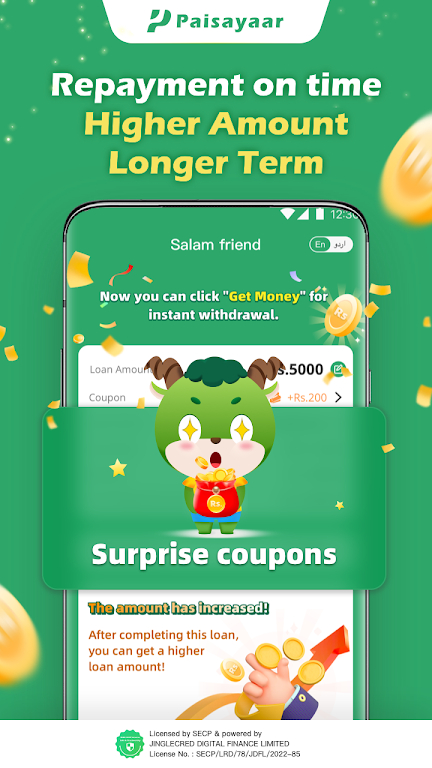

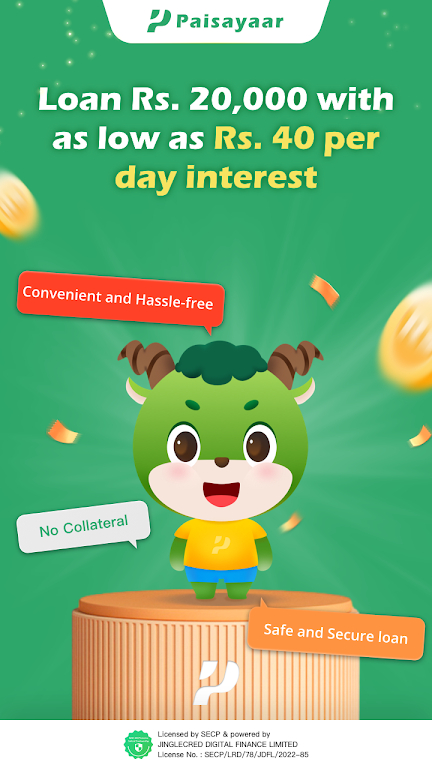

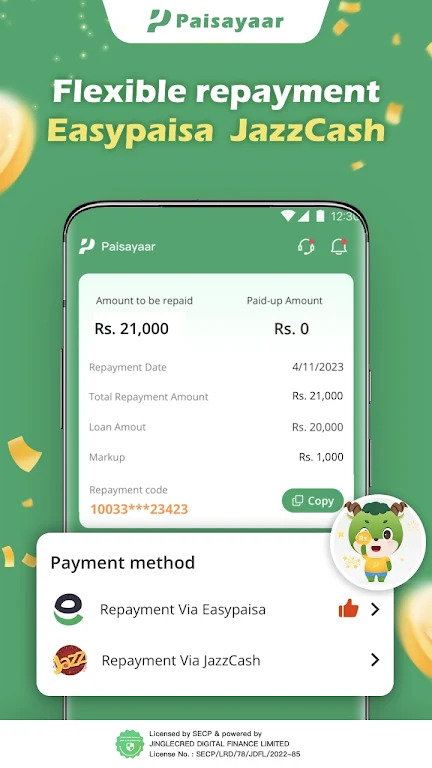

Paisayaar APK is an excellent financial services platform registered in Pakistan. NBFC License Authorized by SECP. Providing fast, flexible, and secure loan services to Pakistani citizens. Users can use their mobile phones anytime and anywhere to pay Rs. You can apply for a personal loan of up to 25,000.

The details of the loan are as follows:

- 1. Loan term: 60 to 90 days

- 2. Loan Amount: Rs. 1,000 to Rs. 25,000

- 3. Maximum Annual Billing Rate (APR): 2% to 12% per year

For example:

- 12,000 for 3 months is calculated as follows:

- Monthly growth rate: 12%/12 = 1%

- Total Surcharge: Rs 12,000*12%/12*3 = Rs 360

- Total refund amount: Rs. 12,000 + Rs. 12,000 360 = Rs. 12,360

- Amount payable monthly: Rs 12,360/3 = Rs 4,120

Product advantages:

- 1. NO LIMITATIONS AND NO WARRANTIES IF YOU ARE 18 AND OLDER.

- 2. You don't have to wait long.

- 3. Check online 24 hours a day.

- 4. Information security, multiple privacy protections to prevent disclosure.

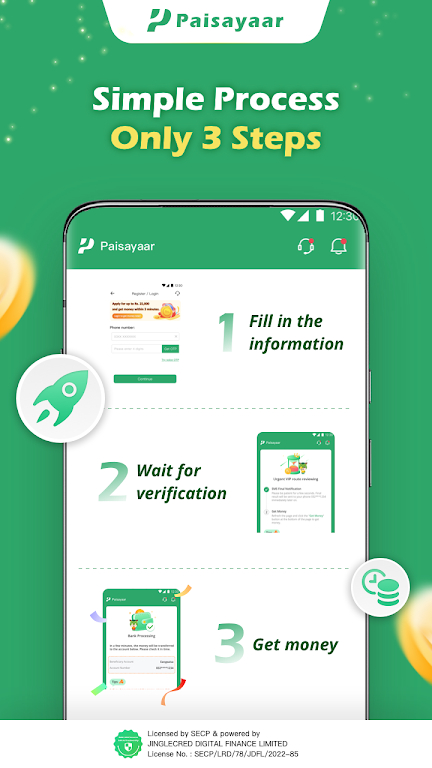

How do I get a loan?

- 1. Download Paisayar on your phone from the Google Play Store.

- 2. Register with your mobile number.

- 3. Enter your personal information, take a clear photo, and submit your application.

- 4. Wait for approval, and delivery begins.

Where can I find an instant loan for private individuals?

Customers can view personal loan offers instantly through dedicated apps or bank and NBFC web platforms. Consumers with good credit should check and compare offers from other lenders through marketplace platforms such as Paisayaar APK.

Pre-approved personal loan through SBI's YONO app.

With SBI's YONO app, select people from the existing customer base can get pre-approved loans in just a few clicks. The SBI app offers features like low processing fees, instant loan approval and disbursement without physical documents, and 24x7 availability. The interest rates for SBI personal loans start from 10.30% p.a. Candidates can take a personal loan of up to Rs 20 lakh with a loan repayment period of up to 6 years.

Axis Mobile application for personal loans.

The Axis Mobile App allows existing customers to instantly apply for a personal loan without paperwork and a fully digitalized loan approval process. Axis Bank's personal loan interest rates start at 10.25% p.a. Loan amounts up to Rs 25 lakh and repayment period up to 5 years.

First bank of IDFC.

Personal borrowers can download the IDFC First Bank mobile app to apply for a personal loan with instant loan approval and disbursement. Personal loan interest rates from IDFC First Bank start at 14.99% per annum. 1 crore and a repayment period of up to 5 years for a loan amount of Rs. Borrowers can also use IDFC First Bank's mobile app to apply for various types of loans, pay their EMIs, get real-time information about loan eligibility and personalized loan offers with attractive interest rates.

Bajaj Finserv Xperia application.

Bajaj Finserv's Xperia app offers customers instant, pre-approved, over-the-counter personal loans. The lender says it will disburse funds within 24 hours of loan approval. Interest rates for personal loans offered by Bajaj Finserv start from 13% per annum. Loan amount up to Rs 25 lakh and loan tenure up to 5 years.

HDFC loan support app.

HDFC Bank's personal loan app allows borrowers to take advantage of personal loans with just a few clicks. It is a popular loan app that helps pre-approved applicants get personal loans in seconds. HDFC offers personal loans at an interest rate of 11% per annum for a loan of up to Rs 40 lakh and a repayment period of up to 6 years.

Tata capital.

Employees and self-employed people can use the Tata Capital app to apply for a personal loan with instant approval and minimal documentation. Individuals with a minimum monthly net income of Rs. 15,000 can get a personal loan immediately, provided they meet other personal loan eligibility requirements specified by the lender. Tata Capital personal loan interest rates start at 10.99% p.a. for up to 35 Lakhs and a loan tenure of up to 7 years.

FIB private loan app (first starting salary).

EarlySalary offers instant personal loans only to salaried customers with a minimum salary of Rs 18,000 monthly for metros and Rs 15,000 for non-metro customers. The app provides online application and document processing, 24/7 availability, and loan disbursement within 10 minutes of lender approval. Candidates can avail themselves of an instant personal loan at 18% p.a. For loans up to Rs 500,000 and repayment periods up to 2 years.

SMFG India Credit Setup App.

Whether employed or self-employed, borrowers can apply for an instant personal loan from SMFG India Credit using the SMFG India Credit app. This instant online application is paperless within 30 minutes of lender approval. Provides document processing and credit distribution. SMFG India Credit personal loan applicants can avail an instant loan at an interest rate of 11.99% p.a. For loans up to Rs 25 lakh and tenures up to 5 years.

FAQs

Q. What is Paisayaar Apk?

This is a new and innovative instant personal loan app for Pakistanis.

Q. Is it safe and legal to download and use?

This online lending app is safe and legal to download and use.

Q. Where can Android users get the free APK of this new loan?

Android users will find the APK file of this new app for free on all official and third-party app stores.

Conclusion

If we talk about online accessible secure channels for banking services, we recommend Paisayaar APK. Android APK is mainly aimed at mobile users in Latin America. Many premium online banking services are available for free by installing the app here. In addition, using the app is entirely free.