InstaMoney APK is a free financial app developed by Innofin Solutions Pvt Ltd. The lending experience in India has changed significantly with this mobile money lending platform that offers instant loans without visiting a personal bank.

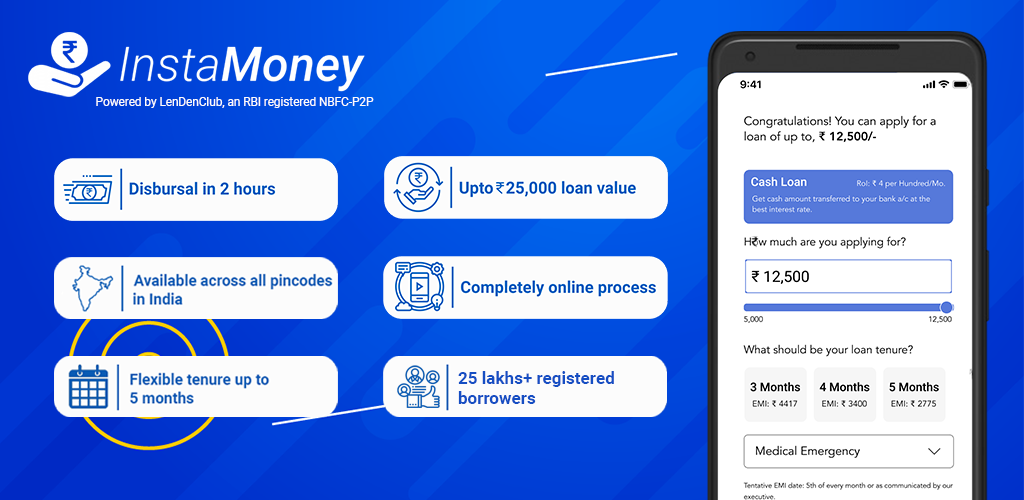

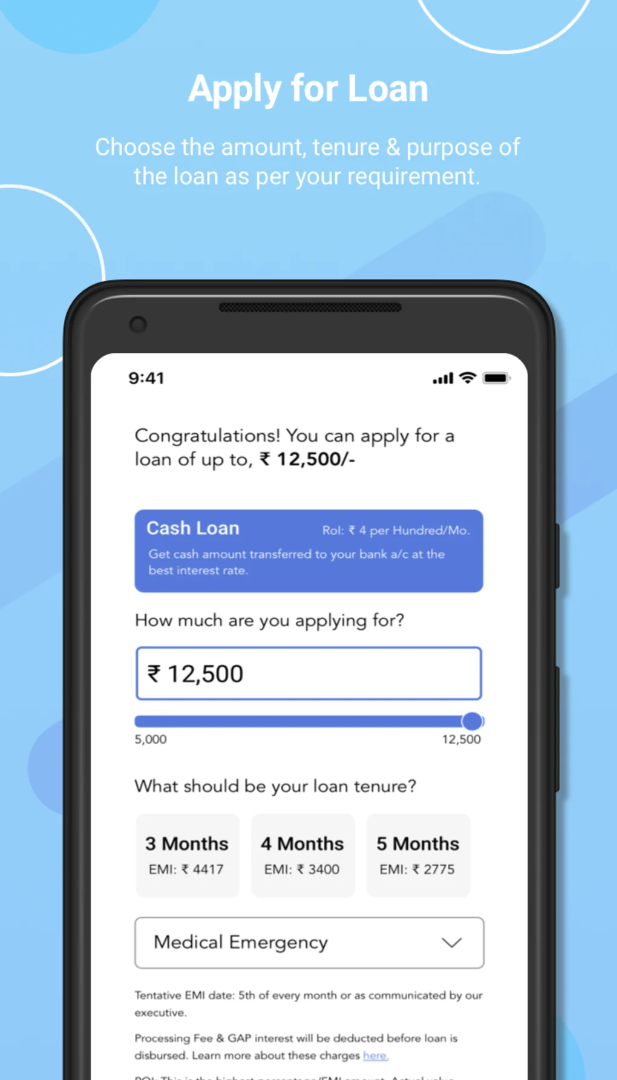

The App gives you the freedom to choose flexible lending options and access loans between ₹5,000 and ₹50,000. You can earn money in just 10 minutes or two hours. Whether you are an employee or self-employed, the best personal loan app ensures instant loan approval for everyone.

InstaMoney is a popular online home loan service designed keeping in mind the financial needs of Indian citizens. The platform offers reliable financing with a loan tenure of up to five months. Borrowers can easily get loans up to INR 5,000 and INR 50,000 within two hours. Additionally, the app includes a minimal processing and evaluation fee of between 0% and 5% depending on your credit score.

The annual interest rate ranges from 24% to 35.88% per annum and the platform does not charge any upfront fees. For example, if you borrow ₹10,000 and choose a five-month repayment period with a service charge of ₹799 and an annual interest rate of 24%, the total interest would be ₹1,000. So the total return is INR 11,799.

You must meet certain eligibility criteria to use this app. Prospective candidates should be Indian citizens between the age of 21 to 45 years and have a valid bank account. The platform is for both employees and self-employed workers. Using this app, you can get instant cash loans for various purposes, including salary advances, credit card payments, medical emergencies, school fees and more.

Features of InstaMoney APK

Expense Tracking: Users can easily record and categorize their expenses, knowing where their money is being spent. This feature helps users identify spending patterns and make informed financial decisions.

Budgeting: InstaMoney APK allows users to set a personal budget based on their financial and income goals. Users can set specific amounts for different spending categories and track their progress in real time.

Goal setting: Users can set short- and long-term financial goals, such as saving for a vacation or paying off debt. Instamoney helps users stay motivated by tracking their progress and informing them on how to achieve those goals faster.

Bill Reminders: The app can send timely reminders for upcoming bill payments, helping users avoid penalties for late or missed payments. Users can set recurring reminders for regular expenses, ensuring they meet their financial obligations.

Reports and Analytics: InstaMoney APK generates detailed reports and analytics based on users' financial data. These visual representations provide detailed information on spending habits, income trends and savings progress, allowing users to make informed financial decisions.

Bank Account Integration: InstaMoney seamlessly syncs users' bank accounts, credit cards and other financial platforms, automatically importing transactions and updating balances. This feature eliminates the need for manual data entry, saving time and ensuring accuracy.

Secure encryption: InstaMoney APK attaches great importance to the security and privacy of users' financial information. The app has strong encryption protocols to protect sensitive data and ensure user information remains secure.

Customization Options: InstaMoney APK often offers customizable settings so that users can customize the app according to their preferences. This includes currency settings, notification settings, and customizing budget categories to fit personal spending habits.

Additional Features of InstaMoney Apk:

- Instant loan up to ₹25,000

- Flexible tenure from 91 days to 150 days

- No bureaucracy

- Transfer money to your bank account in minutes

- No pre-payment penalty, just pay interest on the withdrawn amount

- Salary Loan Advance @ 24%-35.88% p.a. Varies from 2% - 2.99% per month

- Minimum processing fee between 0% - 5% stake

- Get more credit and more products with timely cashback

Why is InstaMoney different from other Instant personal loan Apps?

- More than 3 million users in India

- More than £25 billion (2,500 crores) of debt has already been disbursed

- The highest number of personal loans disbursed by any P2P lending platform in India.

- Get Instant cash loans for various purposes like medical emergencies, credit card payments, school fees, salary advances, etc.

- The sanctioned loan amount can be used to shop online on Amazon, Flipkart, and BigBasket or to book your tickets on Yatra, and MakeMyTrip.

- Loan withdrawal time is from 10 minutes to 2 hours

- Apply for a personal loan through the App and pay through the Apk

- Eligibility Criteria

- Indian citizen

- Between 21 to 45 years of age

- Minimum take-home salary ₹12,000 per month

- The full salary should be in the bank account

- Only 4 documents are required

- PAN card

- Aadhaar Card/Address Proof

- Statement of account

How does Instam InstaMoney work?

- Follow the steps below to get the fastest personal loan in India:

- Log into the Instamoney App, verify eligibility, and pay the evaluation fee for verification.

- Upload required details and documents quickly.

- You will be notified of your approval status within 10 minutes of applying for a personal loan. Sometimes even in real time!

- Once your personal loan is approved, the loan amount will be credited to your bank account within 30 minutes.

Conclusion

You should have gained some valuable insight into how easy most Android apps are to take apart from the techniques and tools presented in this article. Additionally, I hope the InstaMoney Apk download described in this article will become an indispensable addition to your Android development toolkit as it will provide insight into your production APKs, making your App list better.