Cashmum APK provides information on how to get an instant loan. Cashum Instant Personal Loan App on Mobile gives you all the details on how to get Personal Loan, Home Loan, Education Loan, Credit Card Loan, Business Loan, Gold Loan, Car Loan, or Cycle Loan.

Cashmum does not give credit. Get details about top NBFC registered companies Cashmum provides complete details of various lending companies as well as instant cash advances and personal loans from where you can read each loan Application or loan application from the bank can give.

About Cashmum APK

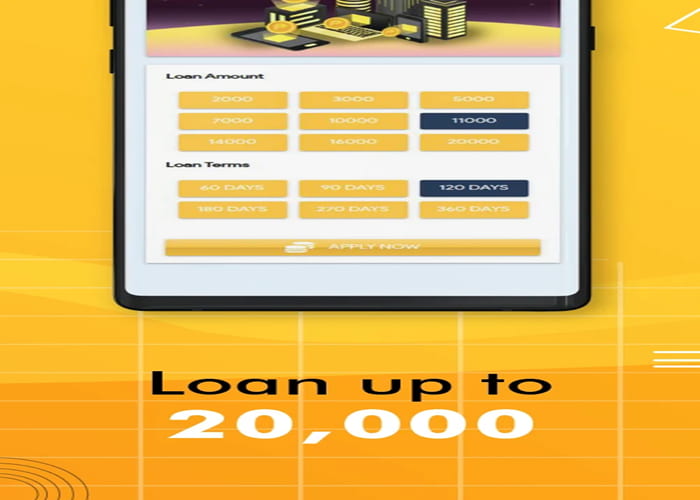

Cashmum APK is the most popular online lending app in the Philippines. The app offers financial solutions in the form of quick and convenient unsecured loans. With just a few valid ID documents, you will receive your payout immediately on the same day, solving your immediate financial problems. It is considered one of the most trusted loan apps in the market. It also offers users benefits that other similar apps do not:

- Credit limit up to PHP 20,000. This is a relatively large amount compared to an unsecured loan, which already poses a high risk for the lender.

- Very competitive interest rates compared to other applications.

- You don't have to meet in person, you don't have to pay at the counter, just transfer the money directly to your bank account.

- No proof of income is required.

- Only documents and photos are required for registration, original documents are not required.

- Flexible loan formulas tailored to the needs of each customer.

- Flexible payments across multiple channels.

- No collateral is required, the loan term can be extended.

Cash interest rate:

Cashmum APK interest rates currently range between 10% and 18.25% per annum. There is also a processing fee, which ranges from 0% to 10% depending on the loan. So the actual amount received is the amount minus the service fee.

The interest rate depends on the loan in question. However, if your credit score is low and you belong to a bad credit group, the institution will assess the level of risk and the interest rate will be higher. Conversely, your credit score is good, your risk level is low, and your interest rate is favorable.

Example of a cash register approval:

- Loan Amount Requested: PHP 20,000.

- Duration: 12 months

- Interest rate: 18% per year.

- Service Fee: 10% x 20,000 = PHP 2,000

- Actual Amount Received: PHP 18,000

- Interest Expense: $20,000 x 18% = PHP 3,600.

- Amount Due: 20,000 + 3,600 = 23,600 PHP.

Cash Loan Requirements:

- The loan conditions at Cashmum APK are very simple, most of which are subject to:

- The people supported are Filipino citizens with full civil liability.

- Age limit 20 to 60 years.

- Have valid identification documents ready.

- Owner's bank account number

- Active phone number.

Loan application Amount and Fees:

- Instant transfer to a bank account

- No bank statements or paychecks required

- 100% paperless process

- Minimum documentation. Expression is not required

- Flexible loan options and EMI rates

- Instant authorization check

- No Deposit (Guarantee)

- Indian citizen

- Above 18 years of age

- Select the city

Required documents:

- Aadhaar Number

- Loan Amount: Rs 50,000

- Term of office: 12 months

- Interest Rate: 22% (with a reduction in principal balance interest calculation)

- EMI: 4680 Rs

- Total Interest Payable: Fixed at Rs 6,157

- Handling Fee (Inclusive of GST): Rs 1,475

- Amount paid: Rs.48,525

Product details:

- Loan Amount: ₹10,000.00 - ₹5,00,000.00

- Loan Tenure: 91 days (minimum including grace period) - 365 days (longest including grace period)

- April: Only 30% and up to 10%

- Transaction Fee: 0

- Service Fee: Processing Fee. Min 0%, Max. 30%

Example: If your loan amount is ₹10,000, APR is 20%, service fee is 10% and tenure is 91 days. The amount due on the due date is $11,498.6 (10,000 * 20% / 365 * 91 + 10,000 + 10,000 * 10%).

Cashmum APK Application Details, we make it very easy for you to get a loan in India!

- Download and install the Instant Loan Online Application.

- Read or borrow the application description.

- Click the Apply button.

- Download the appropriate loan application form.

- And get your bank loan in minutes.

Conclusion

You should have gained some valuable insight into how easy most Android apps are to take apart from the techniques and tools presented in this article. Additionally, I hope the Cashmum Apk download described in this article will become an indispensable addition to your Android development toolkit as it will provide insight into your production APKs, making your App list better.